By Stefán Ólafsson.

Too many households are now in financial trouble. The reason is the significant increase in inflation and interest rates. At the same time, corporate profits have increased to record levels compared to the last 20 years. There is therefore a huge imbalance in society. Affluence in some places – deficiency in others.

The labor movement has presented a plan that innovatively tackles this. Let’s first look at the income trends of households in recent quarters and then the plan of the labor union movement.

Gallup: Household finances continue to deteriorate

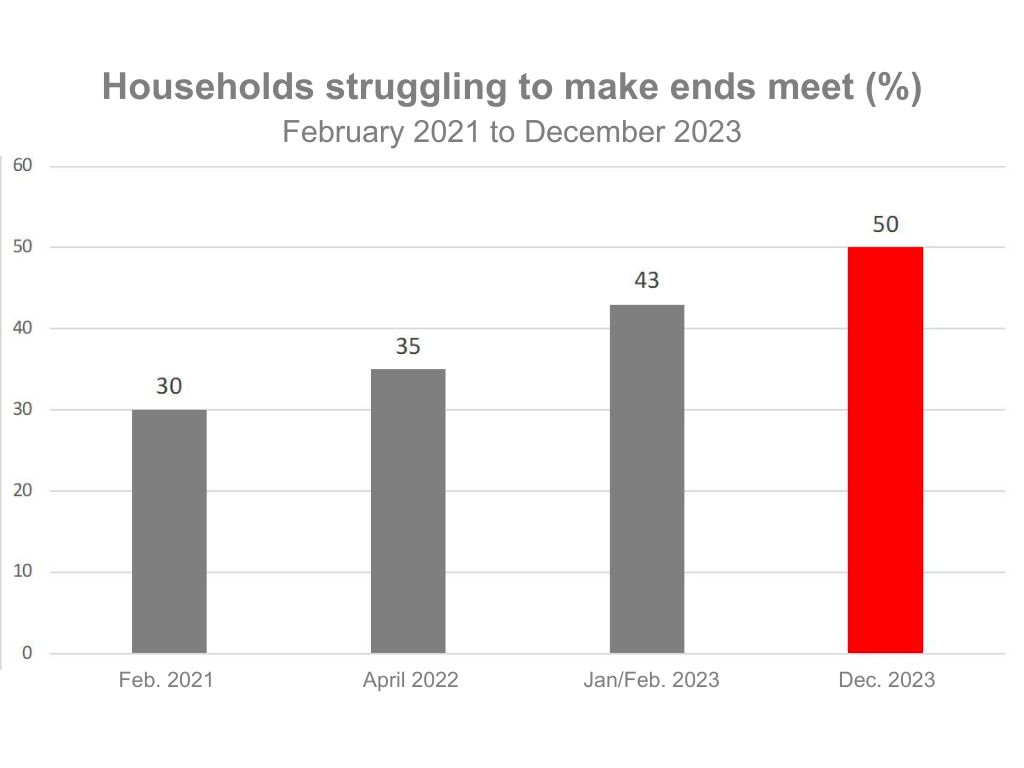

Gallup recently published a new survey on household finances, as the company has done in recent years. Gallup’s data shows that from the second half of 2021, household finances have steadily worsened, during a time of rising inflation and interest rates. In this period the number of households in difficulty has increased from 30% to 50%, or about two-thirds. That’s a substantial increase in a short period.

The figure below shows these results from Gallup’s survey during the period.

Last December about half of households were struggling to make ends meet. Some respondents to the survey accumulated debt, others resorted to savings to make ends meet, and still others barely made ends meet. The situation of low-wage workers is even worse than the picture shows.

There is therefore a real living crisis for far too many households. But at the same time companies prosper. The companies therefore have to lower their profit requirements and reduce prices. The Central Bank, banks, and pension funds also have to play their part in reducing interest rates.

The labor union movement now offers a viable way to achieve all these goals.

The labor movements plan

The Union Alliance, a coalition of the biggest unions within the Icelandic Confederation of Labor (ASÍ) which represents more than 70% of workers in the labor market, has submitted a plan for a rapid reduction in inflation and interest rates. The way consists of unusually modest wage increases (considering the circumstances), the restoration of public redistribution systems (ie child benefit, interest benefit, and housing benefit), and general restraint against price increases. Lower interest rates will then ease the debt burden of indebted households. Moderate wage increases require that workers have certain guarantees for success, in the form of red bars, as was done in the National Consent (Þjóðarsátt) of 1990. Workers who live with shortages cannot alone bear all the risks.

The state needs to increase its contribution to the public redistribution systems, which amounts to about 24 billion króna per year, for the plan to work. If that doesn’t happen the households of low-income people will bleed out and the position of middle-income groups will deteriorate even more than it has already.

Can the state afford to be fully involved?

Individual ministers have recently declared that due to commitments to the residents of Grindavík, the state cannot fully participate in the project with the restoration of the public redistribution systems. The expenditure burden would be too great. However, this is false. The state can handle the project in Grindavík well, among other things by using money that is already available in the Natural Disaster Insurance Fund and back insurances as other ministers have stated.

If success is achieved in reducing inflation and interest rates quickly the government will save considerably more in expenses due to the reduction in interest costs than the increased expenditure in the redistribution systems. Apart from that there are various ways to increase revenue generation for the treasury. For example, it would be reasonable to impose an arrival fee of 4,000-5,000 ISK on tourists, as economics professor Gylfi Zoega has suggested. It would immediately return about 10 billion to the treasury. This would also be a wise move to cool down the tourism industry and thereby reduce the inflationary expansion in society.

An increase in resource rents, bank tax, and other self-evident small adjustments to the tax system that do not involve an increased burden on the public are available, and all of this does much more than paying the 24 billion that is needed. Will is all that is needed in government.

The truth is that the state cannot afford to refuse the labor union movement plan. The other option is unfeasible.

However, the Confederation of Employers’s (SA) opposition to accepting the modest wage increases offered by the Union Alliance and satisfactory guarantees of success is disappointing so far in the negotiations. Employers seem to be tempted to ride through this struggle without contributing anything! If there is no change in SA’s stance, the plan will fail. The same applies if the state fails to act.

What happens if the plan doesn’t work out?

If the state and the companies do not fully deliver then the trade union movement will have to redesign its demands and proceed with a demand for a 7-10% increase in the average salary, thus seeking an increase in purchasing power for households. The household income problem does not allow for anything else in the situation.

But then inflation would go down much slower and the benefits for society as a whole would be much lesser.

Is it not obvious what the path of reason is?

The author is a professor emeritus at the University of Iceland and an expert at Efling.

The article was first published on Vísir on January 27, 2024.