“The Central Bank’s one-sided and intransigence actions against inflation fall with the greatest weight on lower-income and less-asset wage earners.” So says in the resolution of the board of the Efling union, which was approved at the union’s board meeting yesterday. The higher income groups drive private consumption, which fuels inflation. People with lower incomes and less wealth are not responsible for that.

The fifth-highest policy rate in Europe

The Central Bank of Iceland decided yesterday to keep the key interest rate unchanged at 9.25%. That means the key interest rates have been that high for twelve consecutive months. Interest rates are only higher in four other European countries than in Iceland.

Key interest rates are higher in Ukraine than in Iceland, following the Russian invasion. The same can be said about Russia, there the key interest rate is 18%, while in Ukraine it is 13%, and was last lowered in June. The third country is Russia’s satellite state, Belarus, where the interest rate is now 9.5%, and has been falling. The fourth country is Turkey, where the interest rate is a whopping 50%. Inflation in Turkey fell for the first time in 8 months last July but remains at 62%.

Key interest rates in Iceland are considerably higher than in the other Nordic countries. They are the highest in Norway, at 4.5%, then in Finland, at 4.25%, in Sweden at 3.5%, and in Denmark at 3.35%.

Inflation in Iceland has subsided somewhat since it peaked last year, at 10.2%, but now stands at 6.3%. It went down to 5.8% last June.

Efling members are not responsible for inflation

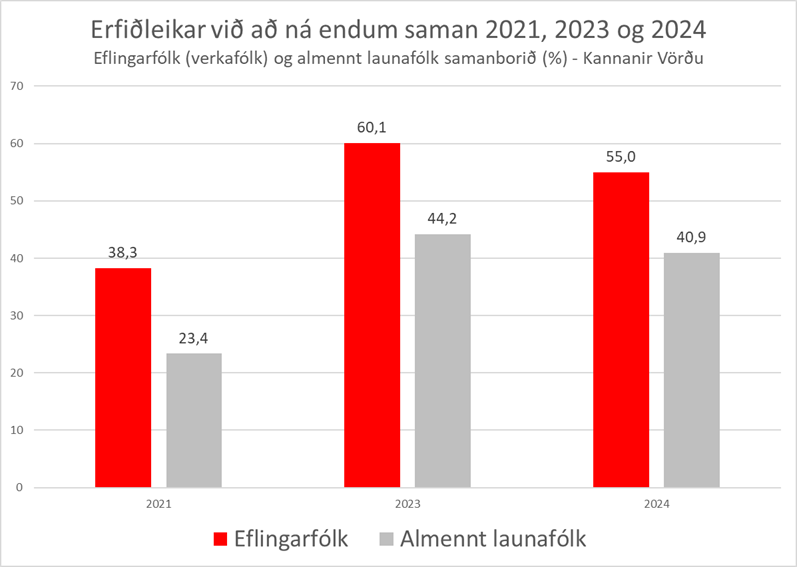

In the resolution of Efling’s board, it is pointed out that over half of Efling’s members have difficulty making ends meet, according to a new survey by the Varða labor market research institute. “These are not the people responsible for inflationary consumption in the country. The actions of the Central Bank are therefore unjust and ineffective.”

The housing crisis and higher food prices, along with other services, are the main causes of inflation, says the resolution of the Efling board. The Central Bank’s actions are not aimed at those factors, but amplify them, if anything. “The board of Efling condemns this unfair and ineffective economic management of the Central Bank and urges the government to address the issues and apply other measures that have a greater impact on the actual causes of inflation”

The resolution can be seen in its entirety below.

The Central Bank goes astray

Resolution of the Board of Efling, 22 August 2024

The Central Bank’s one-sided and intransigence actions against inflation fall with the greatest weight on lower-income and less-asset wage earners. If the current inflation is due to excessive consumption demand, as the Central Bank assumes, then it is not those with lower incomes and fewer assets who are responsible for it, but those who are wealthier.

According to Varða’s survey last spring, around 41% of general wage earners find it difficult to make ends meet, and around 55% of workers in Efling (see attached picture). These are not the people responsible for inflationary consumption in the country. The actions of the Central Bank are therefore unjust and ineffective.

The housing crisis and large increases in the prices of services and food are the most important causes of the current inflation. The Central Bank’s actions do not specifically focus on those factors, but amplify them if anything. This is why the Central Bank has not achieved sufficient success in reducing inflation in recent seasons.

The board of Efling condemns this unfair and ineffective economic management of the Central Bank and urges the government to address the issues and apply other measures that have a greater impact on the actual causes of inflation. It could for example be done by slowing down the expansion in tourism and other industries and by reducing the expansion-stimulating consumption of the more affluent. Then we face the need for decisive interventions in the housing market.