By Stefán Ólafsson:

Households’ purchasing power increased until 2021, due to the Living Wage Agreement concluded in 2019. In the second half of 2021, rising inflation due to increased housing costs and the COVID-19 crisis took hold, which stopped the increase in purchasing power. Then, the invasion of Ukraine in 2022 added even more inflation-stimulating effects.

Finally, the Central Bank’s unusually rapid increases in key interest rates took place, adding to the inflation-stimulating effect of the housing issues, by slowing down housing construction. However, inflation has been persistent.

All these developments put a great burden on households, mostly on the households of indebted families and those with lower incomes.

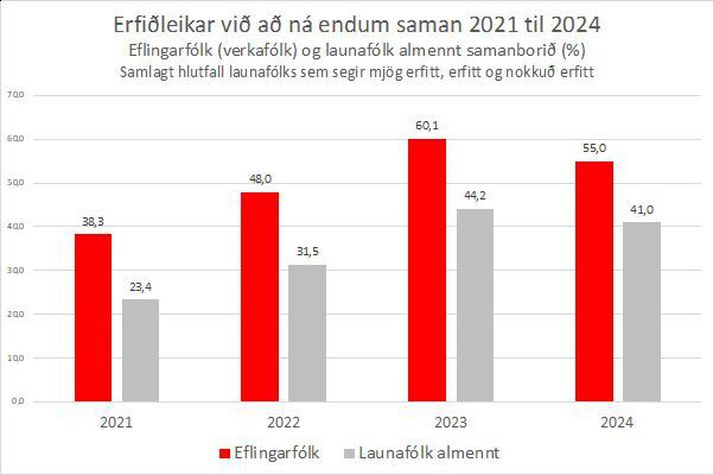

The attached figure shows how the percentage of households that said it was difficult to make ends meet increased from 2021 to 2023 and only slightly decreased until last spring, according to annual surveys by Varða, the labor market research institute.

In 2021, over 23% of the households of ordinary workers said it was difficult to make ends meet. It rose to over 44% in 2023 and then had fallen slightly to around 41%, with falling inflation. It was a small improvement, although in the right direction.

For workers in the capital area (Eflingarfólk in the picture), the situation was much worse, than for other low-income people. The percentage of that group went from around 38% in 2021 to 60% in 2023 and had only dropped to 55% last spring.

When the effects of the new collective bargaining agreement begin to be fully felt this fall, the situation should improve somewhat, but persistently high inflation and interest rates are undermining the expected results of the collective bargaining agreement, which is a grave issue.

Misleading talk and government indifference

Spokespeople for the Central Bank and the government have generally downplayed the difficulties faced by households due to the prevailing conditions and point to the fact that defaults on home loans have increased slightly. It is a misleading argument.

It takes a really deep crisis for mortgage delinquencies to increase significantly, as happened after the financial crash of 2008. Delinquencies have not increased uncontrollably now because households are prioritizing mortgage payments and rent. Because housing is a basic need.

Everything else needs to be done before the households default on loans and rent.

The central bank is achieving only limited success in reducing inflation, even though it has practically extinguished economic growth. The government has not dealt with the housing issues as needed, nor with other tasks that belong to it in the fight against inflation.

The government’s indifference towards the difficult survival of households and pressing projects is probably the most important explanation for the low support of the governing parties at the moment.

The author is a professor emeritus at the University of Iceland and works as an expert at Efling.

The article was first published on Visir.is September 9th 2024.