By Stefán Ólafsson

Those with the highest incomes often receive a large portion of their earnings in the form of capital income, which is taxed at significantly lower rates than the wages of ordinary workers. For example, the top one percent earn the majority of their total income from capital, while for most wage earners, capital income is only a small fraction of their total earnings.

Capital income is thus overwhelmingly concentrated among the highest earners.1 The tax privileges that come with lower taxation of capital income are substantial and primarily benefit those who do not need such support.

This issue is discussed in detail in my book with Arnaldur Sölvi Kristjánsson, Inequality in Iceland, published in 2017. More than two-thirds of all capital income typically goes to the top third of income earners.

In this article, I assess the scope of these tax privileges for the highest earners and compare the amount to government spending on child benefits and housing support for low-income households. The support given to the highest earners is twice as large as the support provided to low-income families.

Let’s first examine the scale of the tax privileges resulting from the unusually low taxation of capital income.

The Scope of Capital Income Tax Privileges

Capital income refers to earnings from assets. These include dividends from shares, capital gains, interest income, and rental income. Capital income is currently taxed at a flat rate of 22% above the personal allowance. In contrast, employment income and pensions are taxed in three brackets: 32%, 38%, and 46% above the personal allowance.

Wage income up to ISK 472,000 per month is taxed at 32%, which is about 10 percentage points higher than the tax on capital income. Those earning ISK 472,000 per month are near the poverty line.

Government revenue from capital income tax in 2023 was approximately ISK 73 billion. If capital income had been taxed at the same rate as the middle bracket of employment income (i.e., 38%), public revenue would have been ISK 52.4 billion higher that year—totaling ISK 125 billion instead of ISK 73 billion. If taxed at the highest bracket (46%), revenue would have increased by ISK 79 billion.

That’s a significant amount—ISK 52 billion or even ISK 79 billion annually—that could be used for infrastructure and welfare services.

Those with the highest capital income (the wealthiest individuals) also tend to have high employment or pension income. Therefore, their capital income would fall into the highest tax bracket (46%) if taxed like employment income. It is thus justifiable to use the higher figure as a measure of capital income tax privileges.

However, let’s take the more conservative route and use the lower figure—ISK 52.4 billion annually—as a general estimate of capital income tax privileges. Let’s then compare this to key public expenditure items in the same year to put these privileges in societal context.

If the capital income of the highest earners were taxed like the wages of ordinary workers (at the middle bracket of 38%), the government would have ISK 52 billion more each year to invest in public infrastructure and welfare.

Much Greater Support for the Wealthy Than the Poor

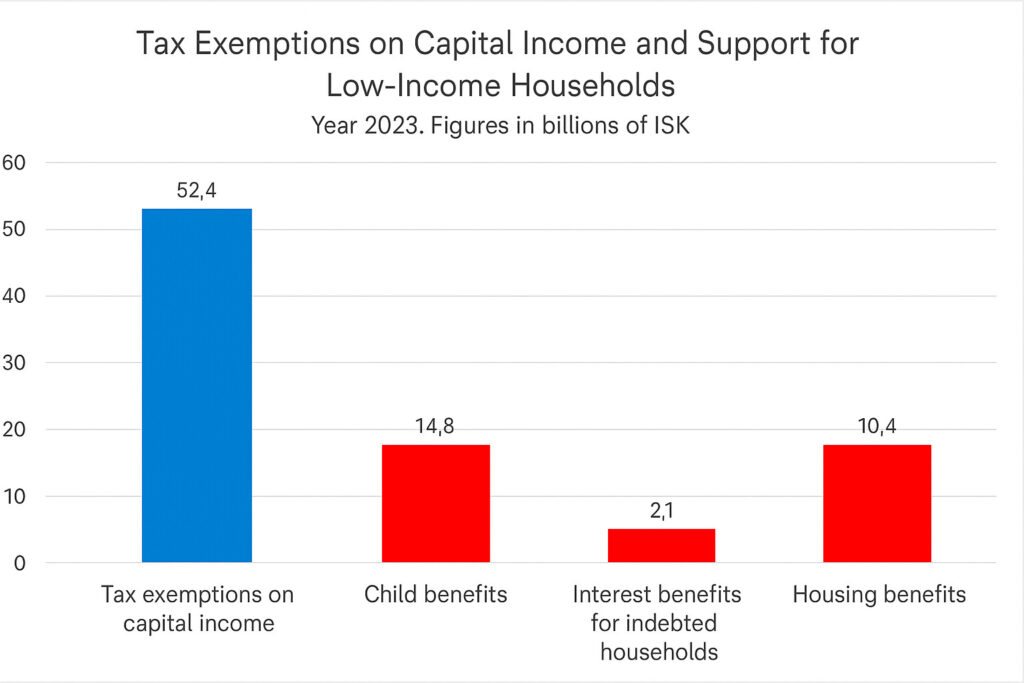

In the image below, we compare the scale of capital income tax privileges to government spending on key support measures for households in lower and middle income groups—specifically support for families during the most financially burdensome periods of their working lives.

This includes transfers to families with children in the form of child benefits, interest subsidies for indebted households, and housing benefits for low-income renters.

As the image clearly shows, the cost to the government of tax discounts on capital income far exceeds the cost of child benefit payments (ISK 52.4 billion vs. ISK 14.8 billion). The cost of housing support (interest and rent subsidies) is almost negligible in comparison.

The total cost of all three support measures for low-income households is around ISK 27 billion. Meanwhile, the support given to the wealthiest and most asset-rich households—through lower taxation of capital income—is nearly double that amount.

Before capital income tax was drastically reduced in 1997, public spending on support for working families was nearly three times higher than it is today. Prior to 1997, capital income was largely taxed like wage income.

Alongside increased tax privileges for the wealthy, support for households in lower and middle-income groups was significantly reduced. The welfare system for the rich flourished while the welfare system for low-income workers was scaled back.

The Icelandic Confederation of Labour (ASÍ) advocates for capital income to be taxed like wage income once again. With the proposed adjustment to capital income taxation, the government would gain five times more revenue than it does from raising fishing fees.

- This is discussed in detail in my book with Arnaldur Sölvi Kristjánsson, Inequality in Iceland, which was published in 2017. More than two-thirds of all capital income typically accrues to the top third of income earners. ↩︎

Stefán Ólafsson is Professor Emeritus at the University of Iceland and works as a specialist for the Efling trade union.

This article was first published in Heimildin on August 22, 2025.