Two out of every three members in Efling with less than 500,000kr in monthly wages have grave worries about their finances. Over a third of all Efling members have had to seek assistance because of their bad financial state, and a quarter did so from friends or family. Many have difficulty making loan payments.

This is according to a survey conducted by Gallup for the union in the fall as part of preparing demands for a new collective agreement.

Women, renters and foreign members worst off

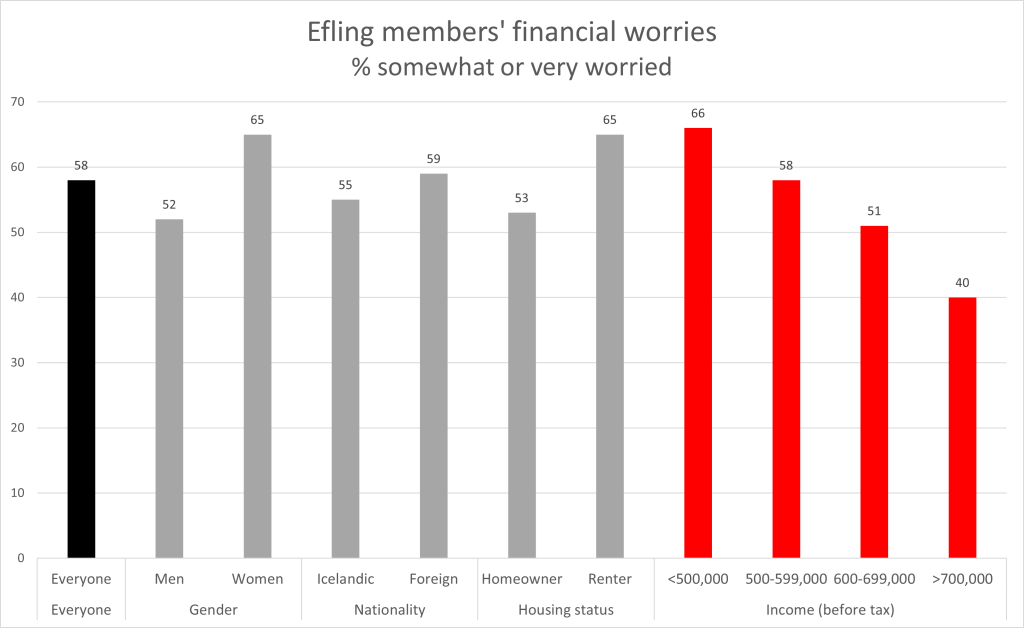

About 58% of all Efling members are somewhat or very worried about their and their family’s financial position. The situation is notably worse among women, at 65% compared to 52% among men. The problems are also more severe for renters than homeowners (65% vs 53%) and among foreign members compared with Icelanders (59% vs 55%).

The chart shows an overview of responses to the question about personal financial worries, broken down by the main subgroups (gender, nationality, housing situation and income).

Proportion of Efling members somewhat or very worried about their and their family’s financial position. Source: Gallup, October 2022.

Worries not limited to the lowest incomes

There is a strong correlation with income; with 66% of those in the lowest income group (those with less than 500,000kr per month) having somewhat or very significant concerns. The proportion lowers with rising incomes, as seen in the graph. Few Efling members have over 700,000kr per month, and those who do often work lots of additional hours, but even so 40% of them are somewhat or very worried about their family’s finances.

About 37% of members have sought assistance due to their financial situation in the last 12 months, most with relatives or friends (26%) or from a commercial bank (14%).

Burdened by overdrafts, instalments and payday loans

About 28% of members have overdraft loans and 23% are paying their credit card companies in instalments, which means high interest rates. Nearly 29% have car loans and 12% are paying off payday loans, which charge usurious interest rates.

Just under 30% of Efling members have had difficulty making loan payments in the last 12 months. Those who are younger and thus on lower wages have generally had more difficulty making debt payments.

An overwhelming majority wants the lowest wages specially raised

The survey gives clear indications about the dire financial straits of Efling members. Stefán Ólafsson discussed the ongoing deficit in low wage workers’ households in the 4th issue of the Efling economic analysis earlier this year.

This reality aligns with the survey’s conclusion that the vast majority of Efling members (over 90%) want a special focus on raising the lowest wages in the coming collective agreements, and further equalizing of wages in society.

Gallup conducted the survey with record participation; 4,632 members participated, four times more than ever before.