By Stefán Ólafsson.

Employers like to state that wage increases are almost solely to blame for inflation. That claim doesn’t stand up to scrutiny.

There is no significant relationship between the increase in inflation and the increase in wages in collective agreements for the last two decades. The fact is that when inflation was at its highest, it was usually due to rising import prices and exchange rate changes – or due to companies raising prices beyond cost increases, to extract increased profits.

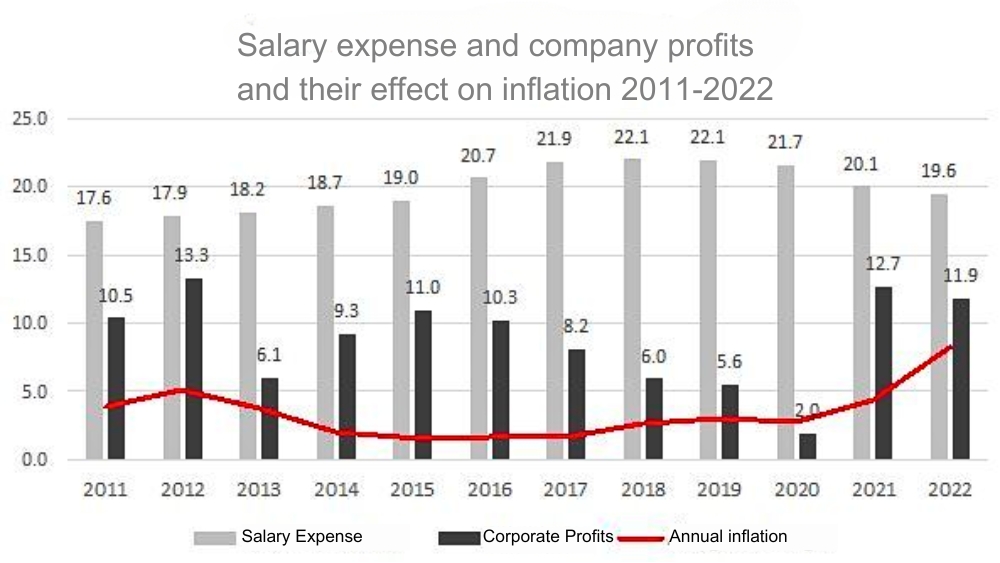

Salary expense has generally been lower when inflation has risen the highest. This is visible in the chart that follows, which shows the Statistics Iceland data on company profits and salary expense as a percentage of turnover – and the relationship with inflation.

The result is clear. Higher inflation is associated with higher corporate profits and relatively low salary expenses.

This was particularly clear in 2021 and 2022 – and indeed also in 2023 (although the data in the chart does not extend there). The same was true in 2011 and 2012 when inflation was at a higher level.

Although the salary expense of companies increased significantly between 2015 and 2018, inflation remained unusually low. Then the profits of companies were decreasing, but still acceptable, except for the 2020 Covid year.

The author is a professor emeritus at the University of Iceland and an expert at Efling.

The article was first published on Vísis on February 14, 2024.