You can only fill in the white fields in the calculator.

To begin with select either Monthly wages or Hourly wages.

If you are on fixed monthly wages (according to your payslip), select Monthly wages and enter your salary into the Monthly wage field.

If you are paid hourly (according to a day work hourly rate on your payslip) select Hourly wages and enter the hourly rate in Salary for daytime. You then enter the amount of hours in the Total daytime / Units field

Time quantity for the collective bargaining agreement –

The time quantity depends on which collective agreement applies for your profession. That number is the deciding number for the day work hourly rate.

For example: under the general agreement between SA and Efling the number of hours for 100% full time work is 173.33 hours according to article 1.5. Under the agreement for hotel and restaurant staff the number of hours for 100% full time work is 172 according to article 1.7 in the agreement. It is important that you know which collective agreement applies to your payslip. Most commonly, the number of hours is 173.33 hours.

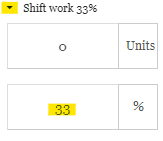

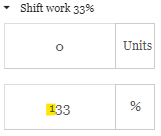

If you need to specify another percentage of the shift work bonus other than the ones given in the calculator (33%, 45%, 90%), you can press the arrow to the left of the shift work fields and enter the correct percentage below:

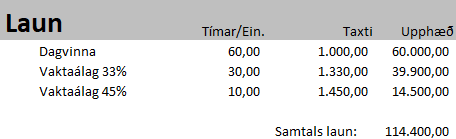

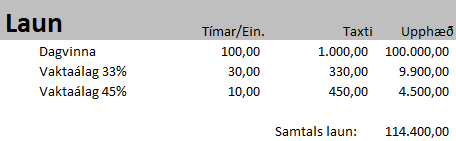

NOTE that the calculator is set up to calculate only the shift work bonus that is added to the daily wage. It may be that this does not match your payslip, as the number of hours and shift work are counted together. To clarify this, here are two examples where the number of hours and kr. amounts are the same, but appear differently on the payslip:

- Shift work and the number of hours worked are added together. E.g. under “Vaktaálag 33%” it is the day work rate (dagvinna) + shift work (Vaktaálag 33%):

- Shift work and the number of hours are not added together. E.g. under “Vaktaálag 33%” only the shift work is counted and the number of hours worked are under “Dagvinna” (day work rate) where all worked hours are counted:

The calculator assumes that all payslips are like example 2 (shift work and day work hours are not added together). If your payslip is like example 1 (shift work and the number of hours are counted together), then it is easy to change how the shift work is calculated. You can click on the arrow to the left of the fields and enter the correct percentage below:

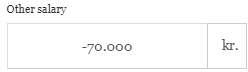

In the case of other types of payment (e.g. rent paid to an employer or prepaid wages), you can other the field Other salary to enter other wages or deductions. A minus must be placed in front of the number if a deduction is to be calculated:

If you wish to enter more field for other payments or deductions you can select the + sign to the right of the field, and it will add a row of fields for more payments or deductions: