By Stefán Ólafsson.

Most people know that mortgage interest rates are very high in Iceland and that it has been so for a long time. But I think few people know how truly abnormal the interest rate has been, and is, in Iceland.

Both nominal and real mortgage rates have been unusually high in Iceland for a long time. It is largely independent of whether inflation is high or low. Iceland is a paradise for banks because this guarantees them a large profit in a normal year. The general public, however, usually has to shell out.

Real interest rates fell somewhat in Iceland during the Covid year (2020), but have since risen rapidly again. Now the real interest rate on indexed mortgages is approaching 4% (above inflation) and the nominal interest rate on non-indexed loans is over 10%. Real mortgage interest rates in Denmark are currently around or below 1%.

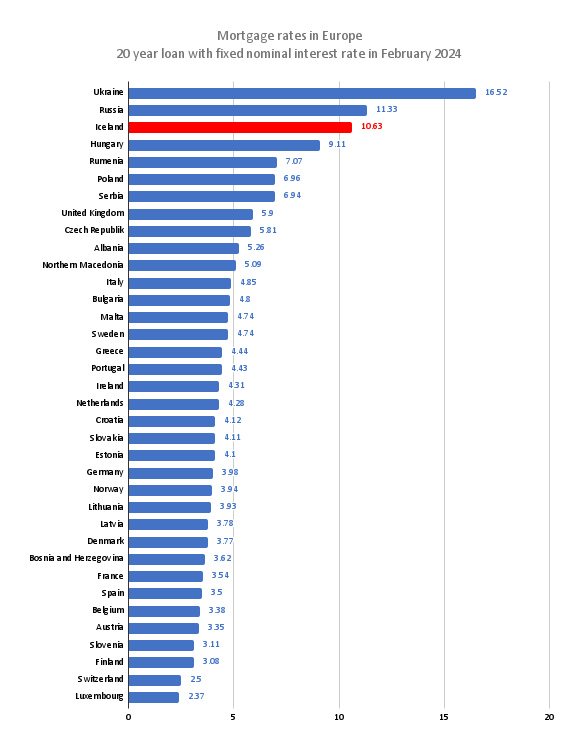

In the picture below, you can see what the nominal interest rates for mortgages with a fixed interest rate of 20 years are at the moment. The numbers come from Numbeo. I also have numbers elsewhere that are similar to these.

Iceland has the 3rd highest nominal mortgage interest rate in this category, after war-torn Ukraine and Russia. We are followed by Hungary, Romania, Poland, and Serbia – which are generally not countries we compare ourselves to.

The other Nordic countries are far below us, with between 3% and 4.7% compared to 10.6% here. This creates a huge pay gap between us and the other Nordic countries.

The author is a professor emeritus at the University of Iceland and an expert at Efling.

The article was first published on Heimildin on February 17, 2024.